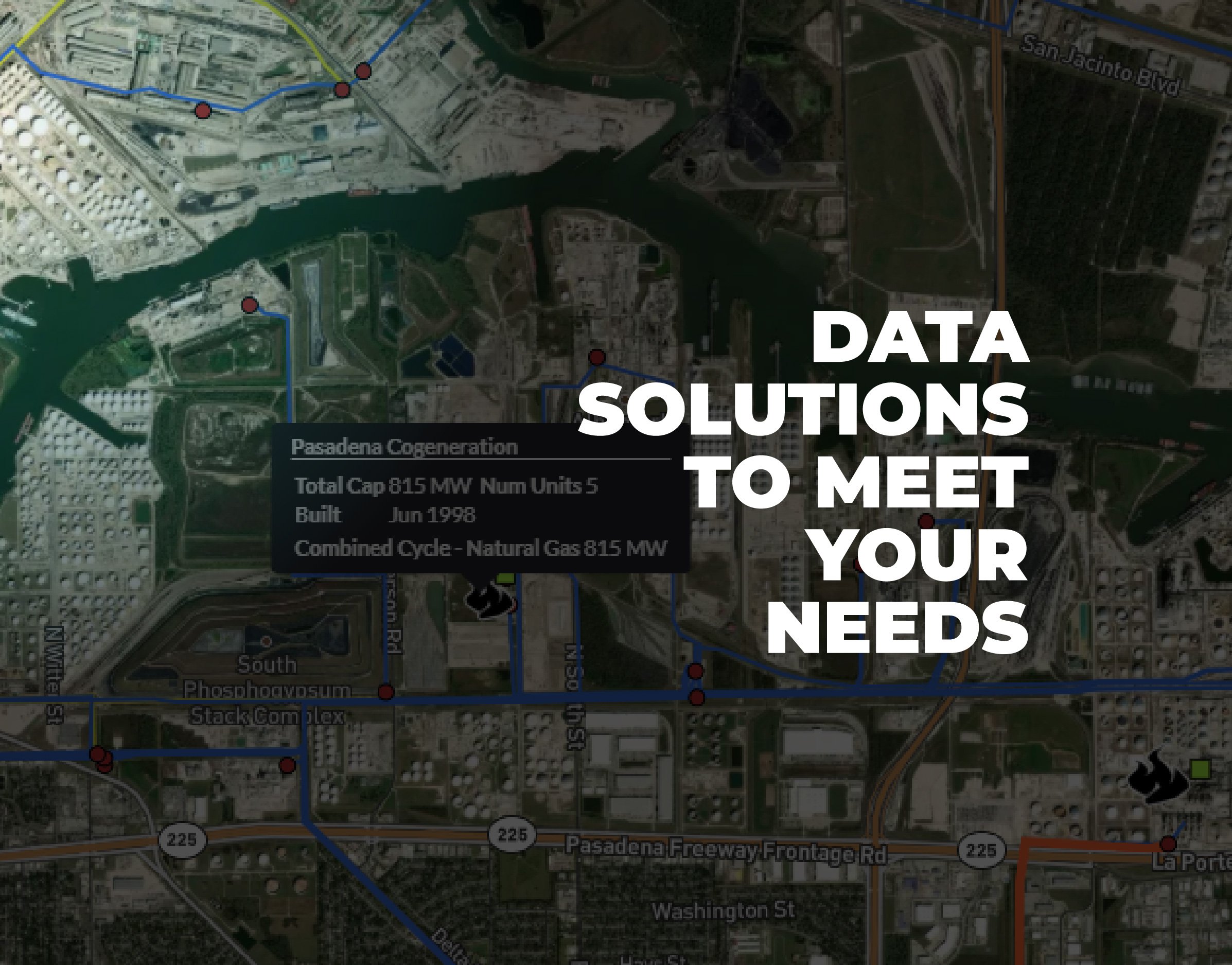

ETRM SOLUTIONS FOR RISK MANAGERS

Get clear, centralized visibility into trading performance and exposure with our robust energy trading risk management (ETRM) solutions. Whether you need to access source data using our secure Cloud, lake, or API technologies or you want an all-encompassing ETRM solution you can easily share across your organization, we have you covered.

Together, our tools make it easy to evaluate risk, validate your positions, and respond confidently to changes in complex, ever-evolving markets.

- Explore unrealized gains or losses your organization holds with FTR Mark-to-Market

- Independent deal capture of cleared trades with all your data in one secure location

- FTR Risk Engine that calculates industry-standard risk metrics (such as Value at Risk) and enables users to drill into the underlying detail supporting the calculations

- Customized dashboard for easy sharing across your organization

What our customers are saying...

.png?width=300&height=300&name=Alex%20%20(1).png)

Alex Robertson

Customer Success Manager

"Energy markets have experienced a rapid surge in market defaults and extreme weather-related volatility. This makes it essential that you have solutions to easily monitor the risks and resulting P&L generated by trading activities."

Read our latest blogs on energy trading and risk management (ETRM) solutions.

INSIGHTS FOR RISK MANAGERS

.png)

New Energy Market Regulations and Trends in 2025

.png)

How to Conduct Financial Transmission Rights Position Analysis in Four Steps

.png)