Free Report: How Grid Transformations Are Reshaping US Power Markets

Explore 2025’s renewable energy trends, grid-scale storage buildout, and interconnection challenges shaping tomorrow’s energy landscape.

Download Your Copy

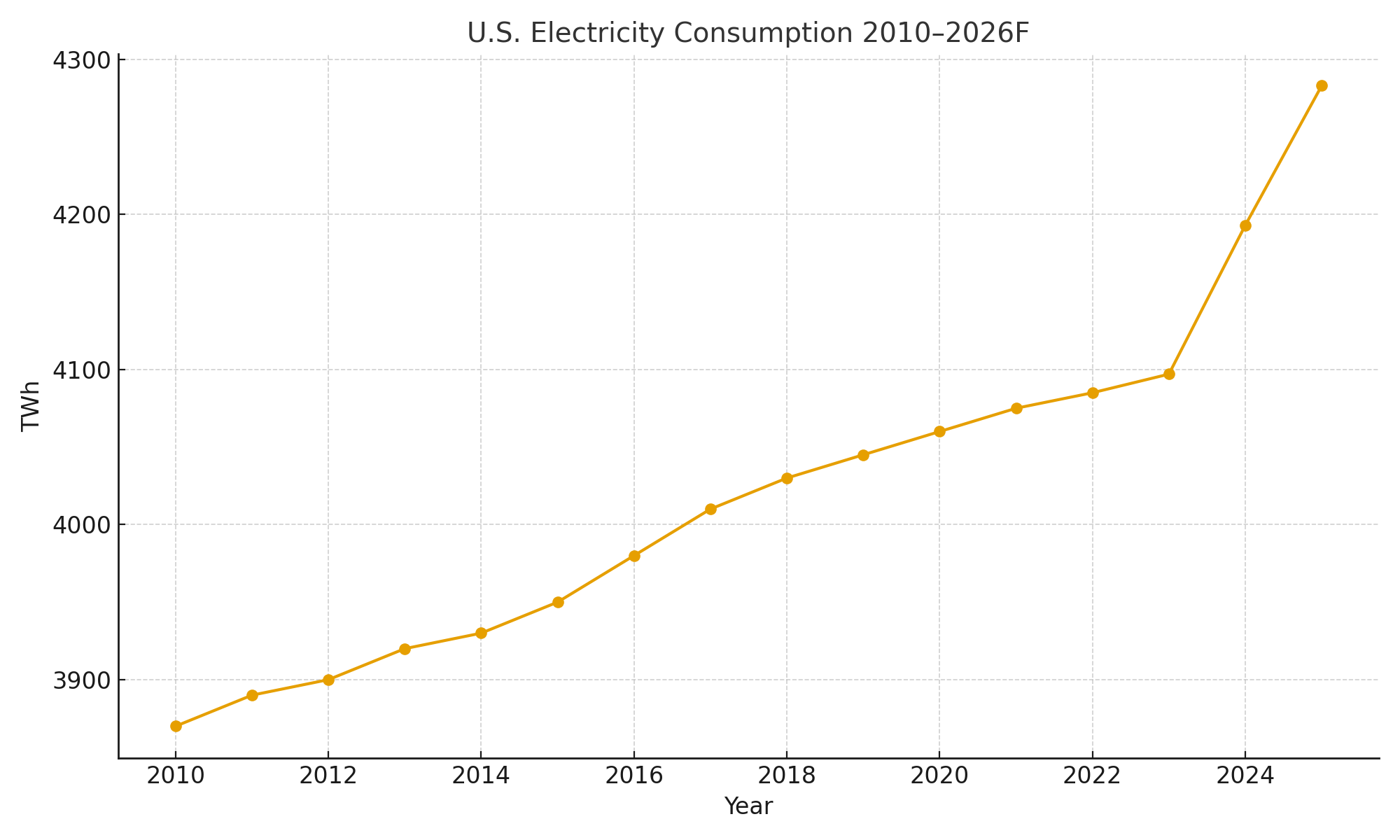

A Once-Predictable Demand Curve Has Been Upended

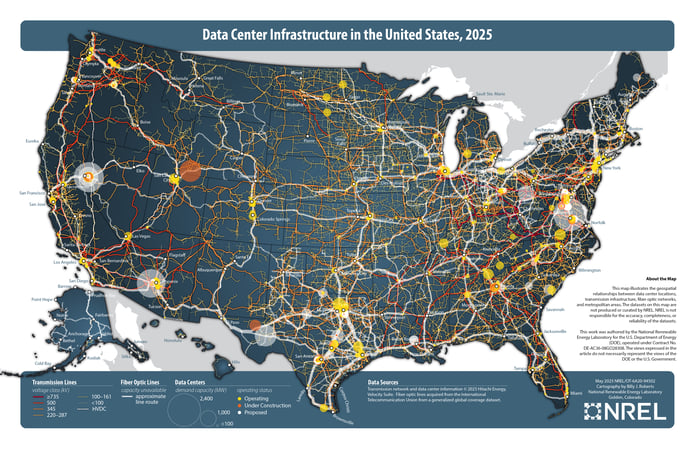

AI-driven data centers, crypto mining, and new industrial loads are driving record electricity demand — while solar and grid-scale battery storage reshape supply. Transmission constraints and interconnection delays are creating both opportunity and risk.

The result? A grid transformation unlike any we’ve seen to date. This white paper breaks down how demand, generation, and infrastructure are transforming – and renewable energy trends you should watch in 2026.

Inside the Report

- Interconnection Queues: What 2,300+ GW of queued generation and grid-scale storage mean for siting and investment.

- Battery Storage Momentum: How leading markets like ERCOT and CAISO are leading grid-scale dispatch innovation.

- Renewable Energy Trends 2025: Why solar and storage will dominate capacity growth.

- Market Implications by Role: How utilities, IPPs, developers, and traders are adapting to congestion and policy shifts.

- Outlook for 2026: Long-duration storage, reliability standards, and siting trends shaping the grid's next phase.

Annual US battery storage additions, 2015-2025F (GW)

Excerpt on Renewable Energy Trends 2025

“Battery storage: The US added 10.4 GW of utility-scale battery capacity in 2024, bringing cumulative storage to >26 GW by year-end, a 66% jump. Developers report plans to add ~19.6 GW more in 2025.

Capacity additions skew to solar and storage: EIA expects ~63 GW of new capacity in 2025, ~81% from solar plus batteries (after a record 30 GW utility-scale solar added in 2024)."

ADDITIONAL INSIGHTS

.png)

ERCOT's Battery Storage Boom: A Strategic Opportunity for Utilities, IPPs, and Developers

.png)

Still Not Modeling Your Energy Storage Projects? It Could Be Costing You Millions

.png)