.png?width=3000&height=329&name=Products%20header%20Position%20Management%20(1).png)

Effortless Visibility into Energy Trading Risk Management and Performance

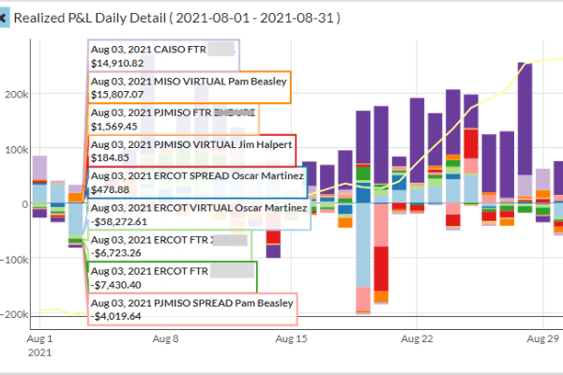

Nodal power markets are constantly evolving. Recently, the markets have experienced a surge in market defaults and extreme weather-related volatility. In this environment, it’s essential to have a solution that allows you to easily monitor the risk being taken and the resulting profit and loss (P&L) generated with your nodal trading activities.

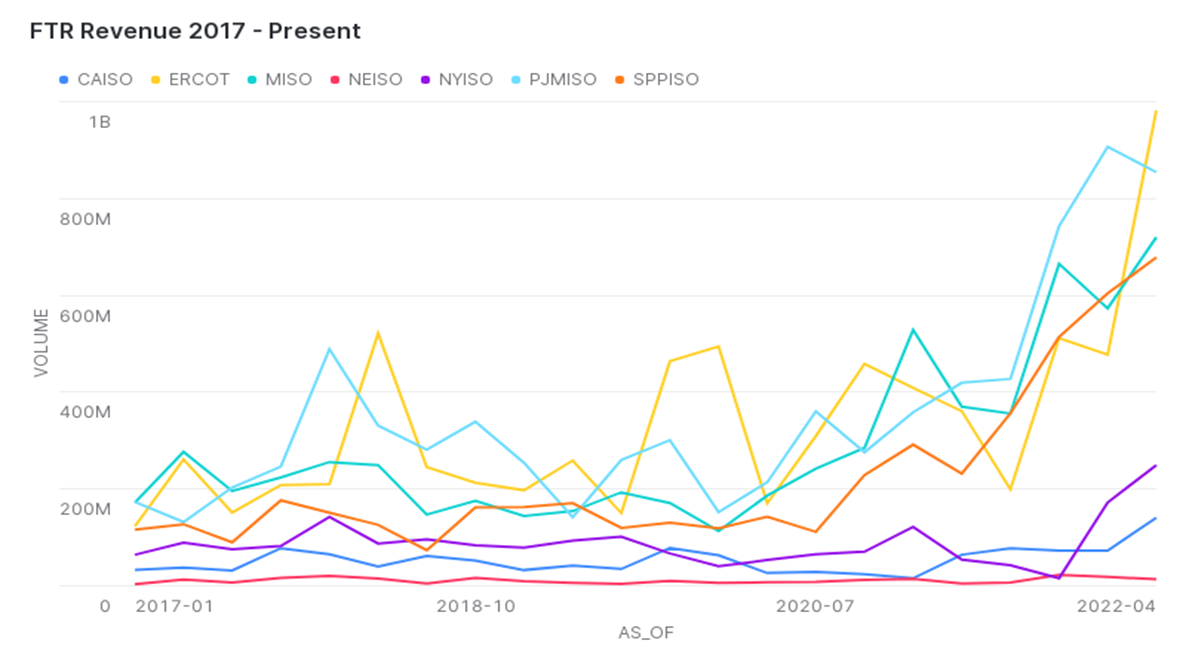

As leaders in nodal power markets, Yes Energy® knows your business. FTRs and virtuals have been our primary focus for over a decade, and with our energy trading and risk management (ETRM) solution Position Management™ we provide unprecedented visibility into what’s driving your trading organization.

KEY BENEFITS

-

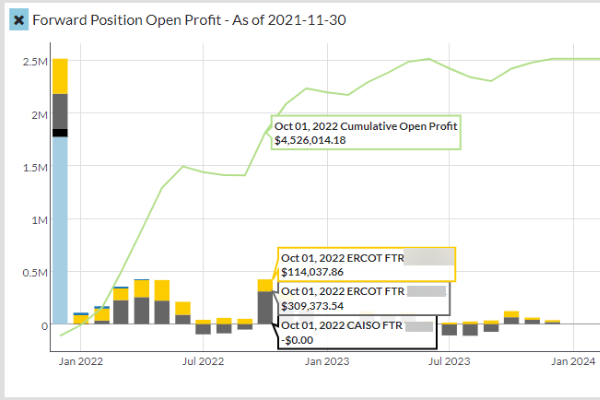

FTR Mark-to-Market - Explore unrealized gains or losses your organization holds by marking-to-market (MtM) open FTR positions with our industry-standard, independent process

-

Deal Capture - See independent capture of cleared trades, so all your data is in one secure location

-

Fully Customizable Dashboard - Create customized insights based on the information most important to you - save them and share your customized insights with the rest of your organization

-

Risk Metrics - Utilize industry-standard risk metrics, which include value at risk (VaR) and stress testing

-

Scheduled Report Delivery - Set the schedule you need and receive the position reporting you care about, delivered directly to your inbox

-

API Integration - Easily integrate position data and metrics like P&L, MtM, and VaR with your in-house reporting and ETRM systems using a library of dependable, easy-to-use APIs

-

Account Management - Easily add or remove traders from the deal capture system, monitor trader certificates, and more

Comfortably Expand Your Market Participation and Support Healthy Markets into the Future.

Position Management provides the nodal power market middle office with a turnkey, consolidated ETRM software solution for oversight of your trading activities. We handle the deal capture and secure storage of transactions across FTRs, virtuals, and spreads with easy-to-set-up market connections. On top of these captured transactions, we generate industry-standard metrics like P&L, mark-to-market, and VaR. We deliver this all to your team through automated email reporting, a visual middle office dashboard, and an easy-to-integrate data API.

Interested in seeing the auction results, P&L and MtM for all market participants?

Check out our FTR Positions Dataset - a premium dataset offering from Yes Energy.

Position Management FAQ

- FTR Mark-to-Market (MtM): We update the MtM valuation of your portfolio with each auction, so you don’t need to rely on trader marks or a manual process.

- Risk Metrics (VaR): We provide auto-calculated risk metrics, such as 95% and 99% VaR.

Unlike a traditional ETRM tool that treats final nodal power markets as an afterthought, Position Management is a nodal trade and risk management system specifically focused on products not handled well by other systems – FTRs, virtuals, and spreads.

You also have to maintain and support your system and institutional knowledge in the case of employee churn. Position Management allows you to reallocate that time and effort toward revenue-generating activities.

Plus, you can more easily avoid the costly mistakes that often result from manually managing data in spreadsheets. We also have a team of experts keeping abreast of any regulatory or market changes and updating our systems accordingly.

You can measure our system configuration and setup time in hours, not months. Plus, our off-the-shelf solution allows for a substantially lower price point than traditional ETRMs in the nodal power trading space.

"It's even allowed me, as a risk manager, to feel more confident in that our traders have the data and tools that they need to be able to make decisions."

Stephanie Staska

Director of Trading

and Risk Products

"Delivering clear visibility around trading risk and performance, our Position Management solution allows trading organizations to comfortably expand their participation and support a healthy market into the future."

INSIGHTS FOR MIDDLE OFFICE

.png)

Capture NYISO TCC Auction Awards Quickly

.png)

Risky Business: Navigating PJM's Risk Requirements and Audits

.png)