Make Confident Dispatch and Development Decisions across Your Portfolio.

No matter what type of asset you're managing or developing, you need to synthesize hundreds of fragmented data points to make informed decisions across both near-term operations and long-term growth.

Yes Energy brings real-time and historical market data into a single view. You can optimize day-ahead and real-time trading decisions, avoid uneconomic dispatch, and manage portfolio risk today, while also evaluating future development opportunities and expansion strategies confidently as market conditions evolve.

What You Need to Stay Ahead

/Solutions%20-%20IPPs/screen-optimize-dispatch-decisions.webp?width=300&name=screen-optimize-dispatch-decisions.webp)

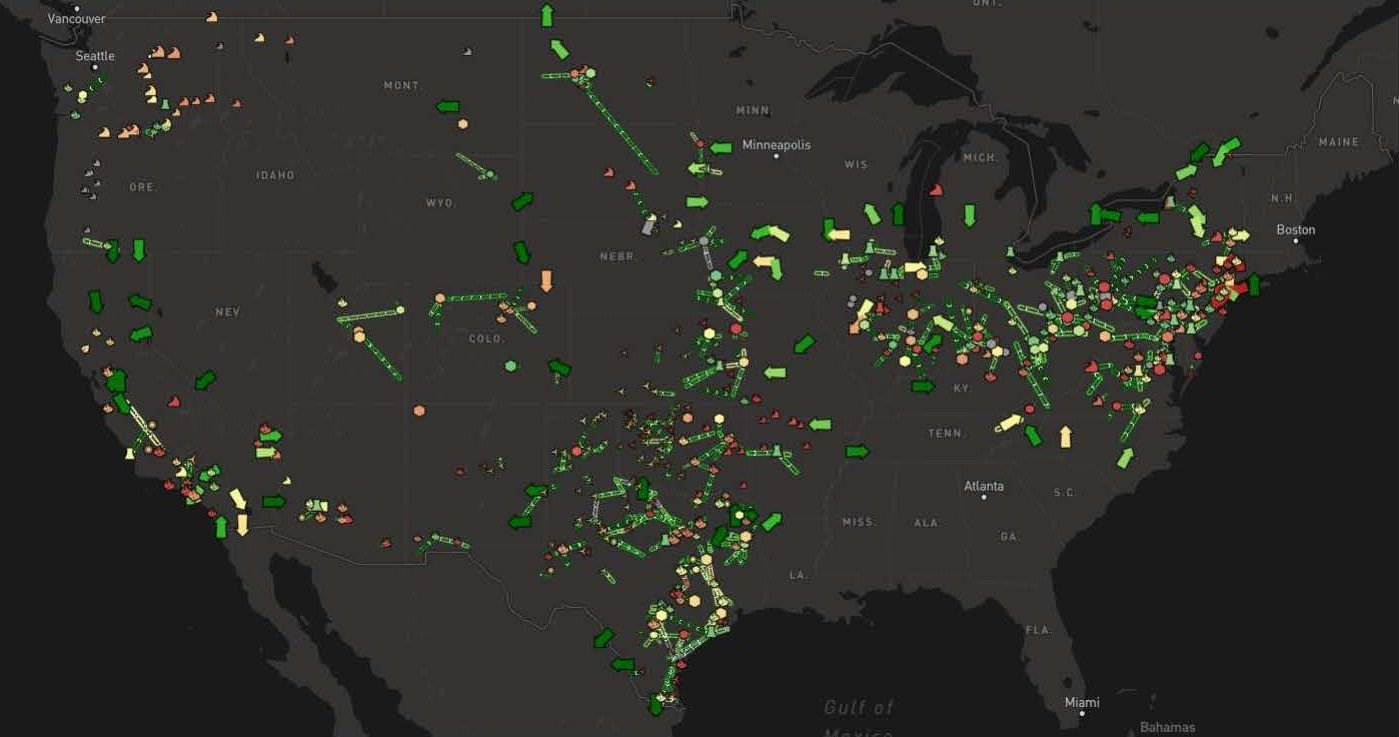

Make informed decisions about when to run your facilities and which assets to dispatch by understanding binding constraints, congestion risk, and localized price impacts. The same insights also help inform where future capacity can be added or expanded so you can protect margins today while guiding smarter development and repowering decisions over time.

/Solutions%20-%20IPPs/screen-first-to-know.webp?width=300&name=screen-first-to-know.webp)

Keep up with the demand, generation, and outage changes impacting prices in real time. See grid shifts and outages instantly, so you can act before volatility erodes margin or increases exposure.

/Solutions%20-%20IPPs/screen-stay-ahead.webp?width=300&name=screen-stay-ahead.webp)

Prioritize the signals that matter most with customizable dashboards and alerts that surface critical changes early. With Yes Energy's low-latency delivery of ISO data, grid conditions, and forecasts in one intuitive view, you gain the clarity to adjust positions as market conditions change.

/Solutions%20-%20IPPs/screen-anticipate-demand.webp?width=300&name=screen-anticipate-demand.webp)

Understand where demand is headed in the near term and how it interacts with supply, congestion, and outages to impact real-time and day-ahead prices. With short-term demand forecasts and longer-term nodal price forecasts in market context, you can plan dispatch and availability more confidently today while also evaluating future development, expansion, and valuation decisions with a clearer view of long-term price dynamics.

Solutions for IPP Workflows

Identify opportunity and risk with comprehensive ISO market data to inform dispatch decisions.

Identify opportunity and risk with comprehensive ISO market data to inform dispatch decisions.

Stay ahead of the market with real-time ISO monitoring dashboards and configurable alerts.

Stay ahead of the market with real-time ISO monitoring dashboards and configurable alerts.

Keep up with demand, generation, and outages impacting prices with minute-by-minute reporting.

Keep up with demand, generation, and outages impacting prices with minute-by-minute reporting.

Make the most informed decisions with analyst-tuned demand forecasts that provide leading accuracy on unpredictable days.

Make the most informed decisions with analyst-tuned demand forecasts that provide leading accuracy on unpredictable days.

Scale operations with engineered, model-ready data for all nodes and markets, delivered through the tech that best fits your business needs.

Scale operations with engineered, model-ready data for all nodes and markets, delivered through the tech that best fits your business needs.

Get fast, intuitive access to historical nodal pricing, congestion drivers, and bankable forecasts to screen and validate sites with confidence.

Get fast, intuitive access to historical nodal pricing, congestion drivers, and bankable forecasts to screen and validate sites with confidence.

More Resources for IPPs

Frequently Asked Questions on Solutions for IPPs

Yes Energy provides normalized and decision-ready data across all major ISOs, combined with tools designed specifically for nodal markets, asset management, trading, and development workflows. Unlike typical energy market data providers, Yes Energy offers a fully integrated ecosystem where you can see pricing, congestion, outages, demand forecasts, and grid conditions in one view. This enables faster operational decisions today while also supporting asset valuation, development, and expansion planning across your portfolio.

Yes Energy synthesizes complex market data into actionable analytics, providing visibility into transmission constraints, congestion drivers, outages, load and generation shifts, and nodal price formation. This enables you to make more informed dispatch and market decisions in the short term. It also allows you to identify where existing assets can be expanded or where new development opportunities may perform best as pricing dynamics evolve.

Yes. Beyond day-ahead and real-time decision making, Yes Energy provides historical market insight and forward-looking forecasts that help you understand how congestion, demand growth, generation additions, and grid evolution may impact asset performance over time. Teams use these insights to evaluate development opportunities, assess expansion or repowering options, and plan portfolio strategy with a clearer view of long-term price and risk dynamics.

Yes Energy helps you identify and manage risk across both short-term operations and long-term portfolio strategy. In the near term, fast and reliable real-time data and configurable alerts surface congestion exposure, outage-driven volatility, and demand shifts early, so teams can protect margins and avoid uneconomic decisions. Over time, historical market context and forward-looking forecasts reveal recurring congestion patterns, structural risks, and evolving grid dynamics. This enables you to make more informed decisions about asset development, expansion, and capital allocation.

You can customize and share dashboards across your organization so teams can all work from the same data and assumptions. This reduces misalignment between teams and ensures everyone sees the same real-time market context and asset impacts.

Yes, you can access data via API, cloud, data lake, or direct integration, connecting seamlessly with ETRMs, in-house tools, and proprietary trading systems.

-1-1.jpeg)